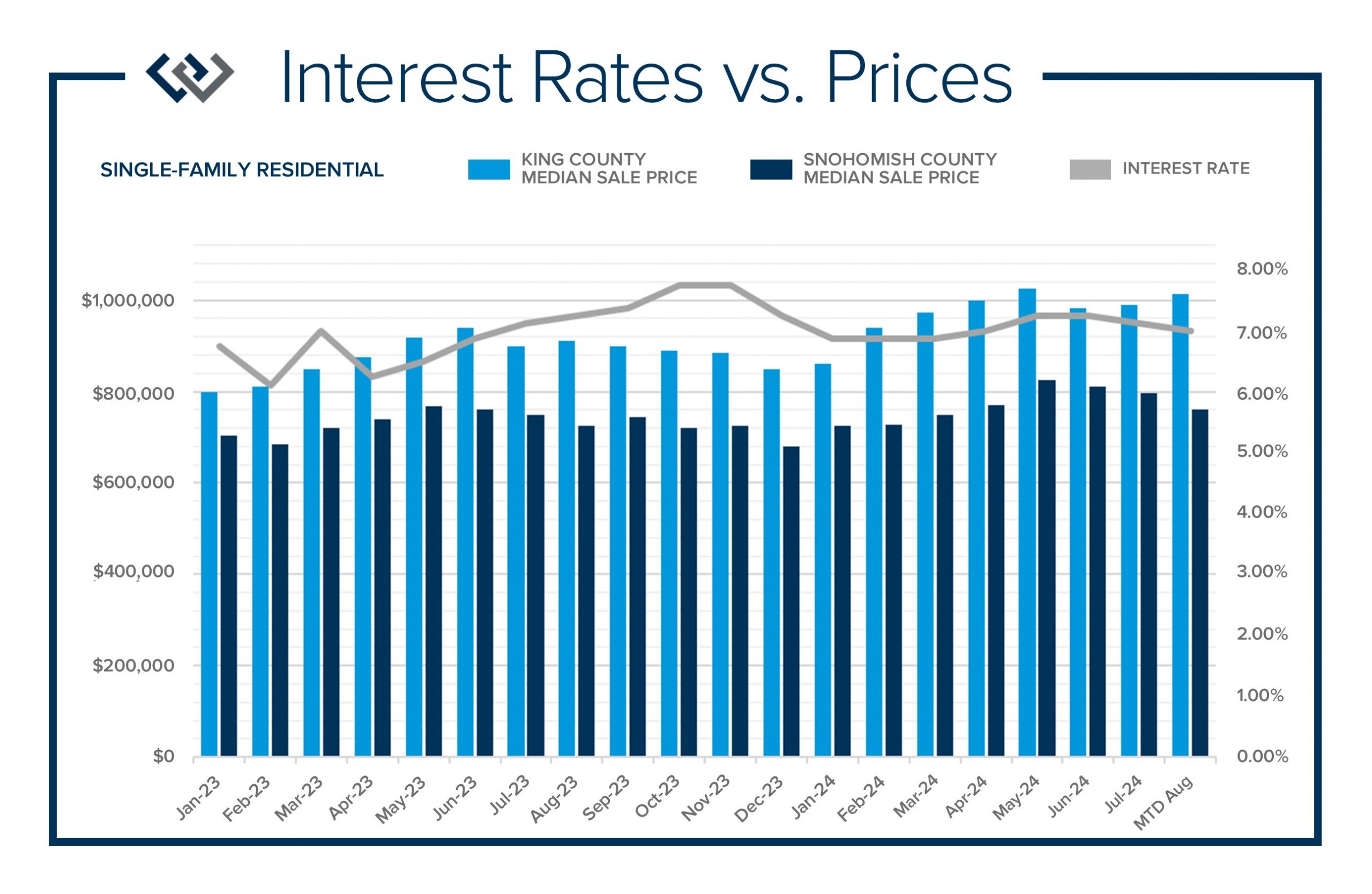

Summer 2024 welcomed an increase in available inventory, a drop in interest rates, and continued price stability, which has upheld strong home equity levels. After a double-digit ramp-up in price appreciation in the first half of 2024, prices have slightly come off the peak of May 2024 and found stability. This trend is historically consistent with seasonal patterns and nothing to be alarmed about.

Increased selection for buyers was a welcome relief as inventory was extremely tight in the spring. While there are still homes getting multiple offers and escalating, we have also seen some buyers make purchases contingent on the sale of their current home. The market has become a bit more nimble for buyer’s terms in some cases. It is important to understand the nuances of each location, product, and price point, as the environment can vary which would indicate whether a buyer would need to compete or be able to negotiate more.

These trends are coupled with rates dropping below 7% in June and they have recently sat in the mid-6%. Rates were a point and a half higher in October 2023; this is a great improvement! We anticipate rates slowly dropping further which will put upward pressure on prices. The Fed meets again this month and if rates come down even more, buyer activity will increase. Between the lower rates and higher inventory, buyers should be excited and ready to act!

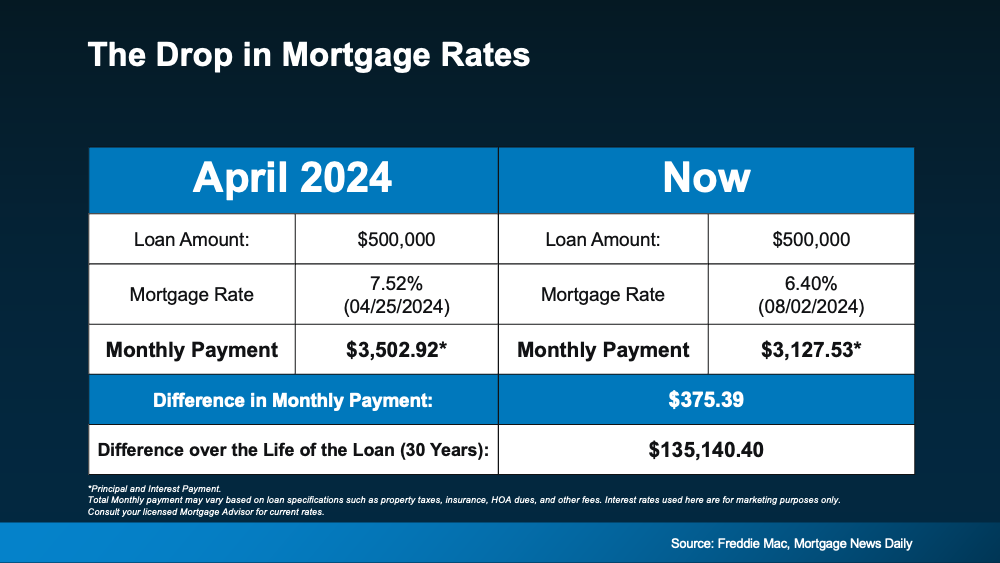

As you can see from the chart below, this shift in rate directly relates to a buyer’s monthly payment. Homes are expensive, so the cost to carry a loan is critical. These recent drops are helping out and should be paid close attention to as buyers are payment-driven in most cases. The opportunity to secure a home now with today’s rate could mean a buyer could enjoy a stable price and choose to re-finance or adjust to a lower rate later keeping their same basis. Buyers should also understand that homeownership is a key component to building wealth.

I anticipate a healthy late summer and fall market. Over the Labor Day Weekend, buyer traffic was busy despite the holiday and activity is bubbling up. The lower rates are helping some folks jump off the fence. Even some sellers are getting ready to sell and relinquish their lower rate, so they can move to a home that better fits their needs. I’m excited about the real estate market for the remainder of 2024 and into 2025. If you are curious about how the trends relate to your goals, please reach out. I am committed to staying connected and up-to-date on the latest trends so my clients make well-informed decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link